Multiple Choice

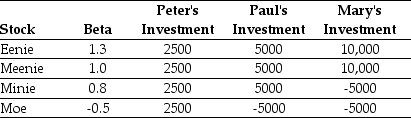

Use the table for the question(s) below.

Consider the following three individuals portfolios consisting of investments in four stocks:

-Assuming that the risk-free rate is 4% and the expected return on the market is 12%,then required return on Peter's portfolio is closest to:

A) 20%

B) 22%

C) 18%

D) 16%

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Use the information for the question(s)below.<br>Sisyphean industries

Q7: Use the information for the question(s)below.<br>Suppose you

Q8: Use the information for the question(s)below.<br>Suppose that

Q14: Use the table for the question(s)below.<br>Consider the

Q15: Use the table for the question(s)below.<br>Consider the

Q70: Use the table for the question(s)below.<br>Consider the

Q80: Use the following information to answer the

Q81: Use the following information to answer the

Q96: Suppose over the next year Ball has

Q130: Use the information for the question(s)below.<br>Suppose you