Multiple Choice

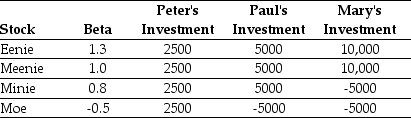

Use the table for the question(s) below.

Consider the following three individuals portfolios consisting of investments in four stocks:

-Which of the following statements is FALSE?

A) Investors may have different information regarding expected returns,correlations,and volatilities,but they correctly interpret that information and the information contained in market prices and they adjust their estimates of expected returns in a rational way.

B) Investors may learn different information through their own research and observations,but as long as they understand the differences in information and learn from other investors by observing prices,the CAPM conclusions still stand.

C) Every investor,regardless of how much information he has access to,can guarantee himself an alpha of zero by holding the market portfolio.

D) The CAPM requires making the strong assumption of homogeneous expectations.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Use the information for the question(s)below.<br>Sisyphean industries

Q12: Use the table for the question(s)below.<br>Consider the

Q15: Use the table for the question(s)below.<br>Consider the

Q49: Use the following information to answer the

Q68: Which of the following statements is FALSE?<br>A)A

Q70: Use the table for the question(s)below.<br>Consider the

Q80: Use the following information to answer the

Q81: Use the following information to answer the

Q96: Suppose over the next year Ball has

Q130: Use the information for the question(s)below.<br>Suppose you