Multiple Choice

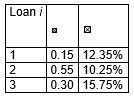

Consider the following table with information on the weightings and expected returns of three assets held by an FI.  What is the expected return on the portfolio (round to two decimals) ?

What is the expected return on the portfolio (round to two decimals) ?

A) (0.15 * 12.35 + 0.55 * 10.25 + 0.30 * 15.75) / 3 = 4.07%

B) (0.15 * 12.35 + 0.55 * 10.25 + 0.30 * 15.75) * 3 = 36.66%

C) 0.15 * 12.35 + 0.55 * 10.25 + 0.30 * 15.75 = 12.22%

D) (12.35 + 10.25 + 15.75) / 3 = 12.78%

Correct Answer:

Verified

Correct Answer:

Verified

Q2: A transition matrix can be used to

Q4: Consider the following portfolio of assets:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4570/.jpg"

Q4: Using the KMV Portfolio Manager Model, the

Q19: Which of the following statements is true?<br>A)Partial

Q32: The most important swap contract in terms

Q38: Assume that an FI's concentration limit on

Q40: Using the KMV Portfolio Manager Model, the

Q45: The concentration limit for a loan portfolio

Q59: Which of the following statements is true?<br>A)Loan

Q67: Loan loss ratio based models estimate systematic