Multiple Choice

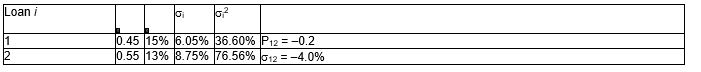

Consider the following portfolio of assets:

What is the variance of the portfolio (round to two decimals) ?

A) (0.45) 2(36.60%) + (0.55) 2(76.56%) + (0.45) (0.55) (-0.2) * (6.05%) (8.75%) = 27.95

B) (0.45) 2(36.60%) + (0.55) 2(76.56%) + 2(0.45) (0.55) (-0.2) * (6.05%) (8.75%) = 25.33

C) (0.45) (36.60%) + (0.55) (76.56%) + 2(0.45) 2(0.55)

D) (-.2) *(6.05%) (8.75%) = 57.28

E) (0.45) (36.60%) + (0.55) (76.56%) + 2(0.45) (0.55) (-0.2) * (6.05%) (8.75%) = 53.34

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Consider the following table with information on

Q2: A transition matrix can be used to

Q4: Using the KMV Portfolio Manager Model, the

Q19: Which of the following statements is true?<br>A)Partial

Q32: The most important swap contract in terms

Q38: Assume that an FI's concentration limit on

Q40: Using the KMV Portfolio Manager Model, the

Q45: The concentration limit for a loan portfolio

Q59: Which of the following statements is true?<br>A)Loan

Q67: Loan loss ratio based models estimate systematic