Multiple Choice

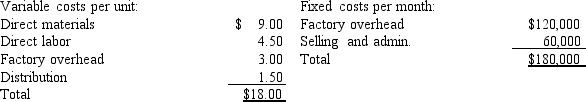

Miller Company produces speakers for home stereo units. The speakers are sold to retail stores for $30. Manufacturing and other costs are as follows:  The variable distribution costs are for transportation to the retail stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.

The variable distribution costs are for transportation to the retail stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.

A Tennessee manufacturing firm has offered a one-year contract to supply speakers at a cost of $17.00 per unit. If Miller Company accepts the offer, it will be able to rent unused space to an outside firm for $18,000 per year. All other information remains the same as the original data. What is the effect on profits if Miller Company buys from the Tennessee firm?

A) decrease of $8,000

B) increase of $9,000

C) increase of $8,000

D) decrease of $6,000

Correct Answer:

Verified

Correct Answer:

Verified

Q42: _ consists of choosing among alternatives with

Q44: Shear-it, Inc., produces paper shredders.Shear-it is considering

Q54: Matching<br><br>Match each statement with the correct item

Q57: In determining the target price of a

Q84: Target costing involves much more up-front work

Q114: Houston Corporation manufacturers a part for its

Q117: Junior Company currently buys 30,000 units of

Q118: Welker Company is designing an all-in-one grill

Q120: Figure 13-8. Kerrigan Lumber Yard receives 12,000

Q128: Which of the following costs is not