Essay

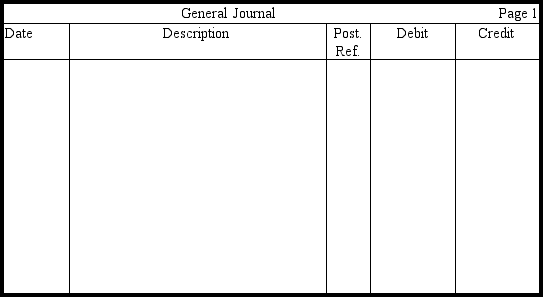

Darla Katz earns an hourly wage of $12,with time-and-a-half pay for hours worked over 40 per week.During the most recent week,she worked 46 hours,her federal tax withholding totaled $62,her state tax withholding totaled $18,and $3 was withheld for union dues.Assuming a 6.2 percent social security tax rate and a 1.45 percent Medicare tax rate,prepare the entry without explanation in the journal provided to record Katz's wages and related liabilities.Round to the nearest penny.

Correct Answer:

Verified

Correct Answer:

Verified

Q50: Interest on a promissory note is recognized

Q68: The current portion of long-term debt is

Q142: At the time a company signs a

Q159: Under what circumstances is a contingent liability

Q187: Use this information to answer the following

Q190: Use this information to answer the following

Q192: Which of the following most likely is

Q193: Peter Perry is paid $12 per hour,plus

Q195: If product X cost $50 and had

Q196: On January 2,2013,Chester Company,a calendar-year company,issued $80,000