Essay

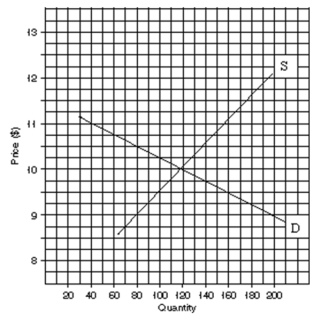

Draw another supply curve S to indicate a $1 tax increase. (a) How much of this tax is borne by the buyer? (b) How much of this tax is borne by the seller?

Correct Answer:

Verified

Correct Answer:

Verified

Q21: An elasticity of 1.5 means that a

Q34: If the income elasticity for Ramen Noodles

Q93: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5854/.jpg" alt=" A.How much

Q93: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5852/.jpg" alt=" -About how

Q99: Which of the following statements best represents

Q129: If the price of chocolate goes up

Q188: Advertisers go to great lengths to build

Q196: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5852/.jpg" alt=" -Which statement is

Q211: In general taxes on goods and services<br>A)are

Q231: Statement I: Over time the demand for