Essay

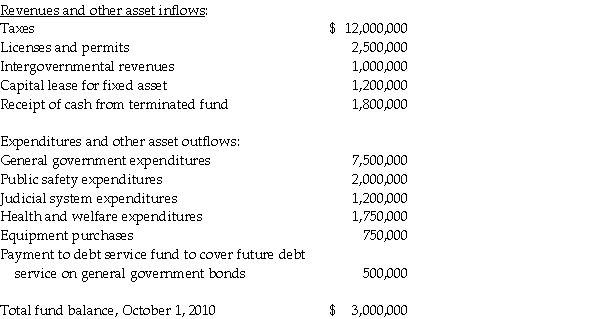

The following information regarding the fiscal year ended September 30,2011,was drawn from the accounts and records of the Mayberry County general fund:

Required:

Required:

Prepare a statement of revenues,expenditures,and changes in fund balance for the Mayberry County general fund for the year ended September 30,2011.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Assume you are preparing journal entries for

Q3: Middlefield County incurred the following transactions during

Q5: The estimated revenues control account of Metro

Q7: Bounty County had the following transactions in

Q9: The City of Electri entered the following

Q10: Peking County incurred the following transactions during

Q18: At any point in time,a government will

Q20: Which of the following represents the recording

Q21: Which statement below is incorrect with respect

Q34: 1.Urban City issued $6 million of general