Essay

Krull Corporation is preparing its interim financial statements for the third quarter of calendar 2011.

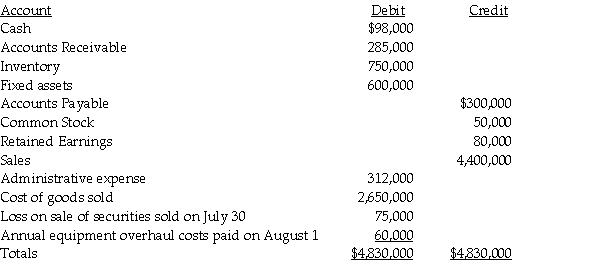

The following trial balance information is available for third quarter:

Additional information:

Additional information:

At the end of the year,Krull distributes annual employee bonuses and charitable donations that are estimated at $40,000,and $12,000,respectively.The cost of goods sold includes the liquidation of a $45,000 base layer in inventory that Krull will restore in the fourth quarter at a cost of $75,000.Effective corporate tax rate for 2011 is 32%.

Required:

Prepare Krull's interim income statement for the third quarter of calendar 2011.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: What is the threshold for reporting a

Q29: For an operating segment to be considered

Q32: Leotronix Corporation estimates its income by calendar

Q33: Nettle Corporation is preparing its first quarterly

Q34: The following data relate to Falcon Corporation's

Q35: The following table is provided in the

Q36: Sandpiper Corporation paid $120,000 for annual property

Q38: The estimated taxable income for Shebill Corporation

Q40: Maxtil Corporation estimates its income by calendar

Q45: Jacana Company uses the LIFO inventory method.During