Essay

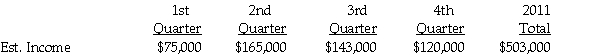

Nettle Corporation is preparing its first quarterly interim report.It is subject to a corporate income tax rate of 20% on the first $50,000 of taxable income and 35% on taxable income above $50,000.Its estimated pretax accounting income for 2011,by quarter,is:

Nettle expects to earn and receive operating income for the year and does not contemplate any changes in accounting procedures or principles that would affect its pretax accounting income.

Nettle expects to earn and receive operating income for the year and does not contemplate any changes in accounting procedures or principles that would affect its pretax accounting income.

Required:

1.Determine Nettle's estimated effective tax rate for 2011.

2.Prepare a schedule to show Nettle's estimated net income for each quarter of 2011.

Correct Answer:

Verified

_TB1535_00...

_TB1535_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: What is the threshold for reporting a

Q28: Which one of the following operating segment

Q32: Leotronix Corporation estimates its income by calendar

Q34: The following data relate to Falcon Corporation's

Q35: The following table is provided in the

Q36: Sandpiper Corporation paid $120,000 for annual property

Q37: Krull Corporation is preparing its interim financial

Q38: The estimated taxable income for Shebill Corporation

Q40: Similar operating segments may be combined if

Q45: Jacana Company uses the LIFO inventory method.During