Essay

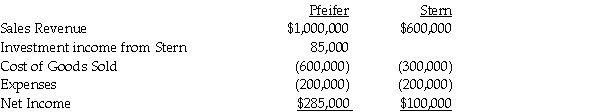

Pfeifer Corporation acquired an 80% interest in Stern Corporation several years ago when the book values and fair values of Stern's assets and liabilities were equal.At the time of acquisition,the cost of the 80% interest was equal to 80% of the book value of Stern's net assets.Separate company income statements for Pfeifer and Stern for the year ended December 31,2011 are summarized as follows:

During 2010,Pfeifer sold merchandise that cost $120,000 to Stern for $180,000.Half of this merchandise remained in Stern's inventory at December 31,2010.During 2011,Pfeifer sold merchandise that cost $150,000 to Stern for $225,000.One-third of this merchandise remained in Stern's December 31,2011 inventory.

During 2010,Pfeifer sold merchandise that cost $120,000 to Stern for $180,000.Half of this merchandise remained in Stern's inventory at December 31,2010.During 2011,Pfeifer sold merchandise that cost $150,000 to Stern for $225,000.One-third of this merchandise remained in Stern's December 31,2011 inventory.

Required:

Prepare a consolidated income statement for Pfeifer Corporation and Subsidiary for 2011.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Plateau Incorporated bought 60% of the common

Q19: Use the following information to answer the

Q20: Use the following information to answer the

Q20: The material sale of inventory items by

Q21: Perry Instruments International purchased 75% of the

Q22: Use the following information to answer the

Q24: A(n)_ sale is a sale by a

Q25: Use the following information to answer the

Q26: Use the following information to answer the

Q27: Use the following information to answer the