Essay

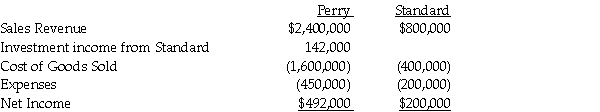

Perry Instruments International purchased 75% of the outstanding common stock of Standard Systems in 1997 when the book values and fair values of Standard's assets and liabilities were equal.The cost of Perry's investment was equal to 75% of the book value of Standard's net assets.Separate company income statements for Perry and Standard for the year ended December 31,2011 are summarized as follows:

During 2011,the companies began to manage their inventory differently,and worked together to keep their inventories low at each location.In doing so,they agreed to sell inventory to each other as needed at a markup of 10% of cost.Perry sold merchandise that cost $100,000 to Standard for $110,000,and Standard sold inventory that cost $80,000 to Perry for $88,000.Half of this merchandise remained in each company's inventory at December 31,2011.

During 2011,the companies began to manage their inventory differently,and worked together to keep their inventories low at each location.In doing so,they agreed to sell inventory to each other as needed at a markup of 10% of cost.Perry sold merchandise that cost $100,000 to Standard for $110,000,and Standard sold inventory that cost $80,000 to Perry for $88,000.Half of this merchandise remained in each company's inventory at December 31,2011.

Required:

Prepare a consolidated income statement for Perry Corporation and Subsidiary for 2011.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Proman Manufacturing owns a 90% interest in

Q17: Phast Corporation owns a 80% interest in

Q18: Plateau Incorporated bought 60% of the common

Q19: Use the following information to answer the

Q20: Use the following information to answer the

Q20: The material sale of inventory items by

Q22: Use the following information to answer the

Q23: Pfeifer Corporation acquired an 80% interest in

Q25: Use the following information to answer the

Q26: Use the following information to answer the