Essay

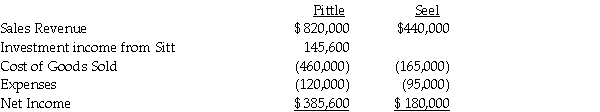

Pittle Corporation acquired a 80% interest in Seel Corporation at a cost equal to 80% of the book value of Seel's net assets several years ago.At the time of purchase,the fair value and book value of Seel's assets and liabilities were equal.Pittle purchases its entire inventory from Seel at 150% of Seel's cost.During 2011,Seel sold $490,000 of merchandise to Pittle.Pittle's beginning and ending inventories for 2011 were $72,000 and $66,000,respectively.Income statement information for both companies for 2011 is as follows:

Required:

Required:

Prepare a consolidated income statement for Pittle Corporation and Subsidiary for 2011.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Presented below are several figures reported for

Q3: Salli Corporation regularly purchases merchandise from their

Q4: Swamp Co. ,a 55%-owned subsidiary of Pond

Q5: Pexo Industries purchases the majority of their

Q6: Plover Corporation acquired 80% of Sink Inc.equity

Q7: Peel Corporation acquired a 80% interest in

Q8: On January 1,2011,Paar Incorporated paid $38,500 for

Q9: Use the following information to answer the

Q11: Preen Corporation acquired a 60% interest in

Q25: Assume there are routine inventory sales between