Essay

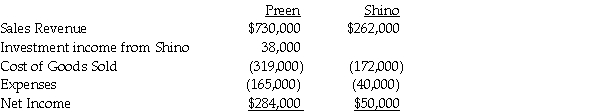

Preen Corporation acquired a 60% interest in Shino Corporation at a cost equal to 60% of the book value of Shino's net assets in 2010.At the time of acquisition,the book value and fair value of Shino's assets and liabilities were equal.During 2011,Preen sold $120,000 of merchandise to Shino.All intercompany sales are made at 150% of Preen's cost.Shino's beginning and ending inventories resulting from intercompany sales for 2011 were $60,000 and $36,000,respectively.Income statement information for both companies for 2011 is as follows:

Required:

Required:

Prepare a consolidated income statement for Preen Corporation and Subsidiary for 2011.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Plover Corporation acquired 80% of Sink Inc.equity

Q7: Peel Corporation acquired a 80% interest in

Q8: On January 1,2011,Paar Incorporated paid $38,500 for

Q9: Use the following information to answer the

Q12: Use the following information to answer the

Q13: Use the following information to answer the

Q14: Papal Corporation acquired an 80% interest in

Q15: Paulee Corporation paid $24,800 for an 80%

Q16: Proman Manufacturing owns a 90% interest in

Q25: Assume there are routine inventory sales between