Essay

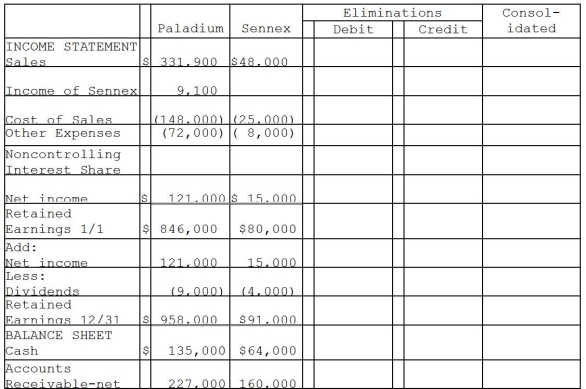

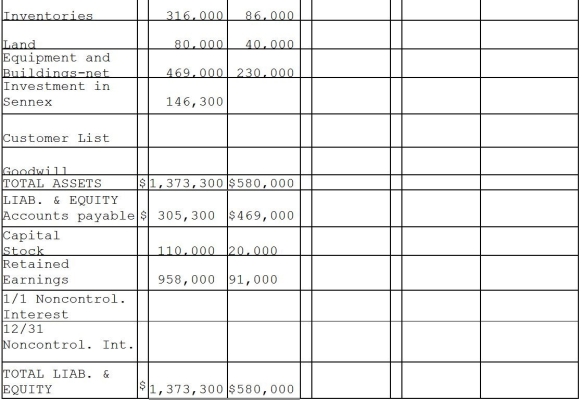

On December 31,2011,Paladium International purchased 70% of the outstanding common stock of Sennex Chemical.Paladium paid $140,000 for the shares and determined that the fair value of all recorded Sennex assets and liabilities approximated their book values,with the exception of a customer list that was not recorded and had a fair value of $10,000,and an expected remaining useful life of 5 years.At the time of purchase,Sennex had stockholders' equity consisting of capital stock amounting to $20,000 and retained earnings amounting to $80,000.Any remaining excess fair value was attributed to goodwill.The separate financial statements at December 31,2012 appear in the first two columns of the consolidation workpapers shown below.

Required:

Complete the consolidation working papers for Paladium and Sennex for the year 2012.

Paladium

Correct Answer:

Verified

_TB1535_00...

_TB1535_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: On consolidated working papers,a subsidiary's net income

Q9: On January 1,2011,Persona Company acquired 80% of

Q11: Pennack Corporation purchased 75% of the outstanding

Q12: On January 2,2011,Paleon Packaging purchased 90% of

Q13: When performing a consolidation,if the balance sheet

Q16: In contrast with single entity organizations,consolidated financial

Q25: Use the following information to answer question(s)

Q27: A parent corporation owns 55% of the

Q38: When preparing the consolidation workpaper for a

Q48: When preparing consolidated financial statements,which of the