Essay

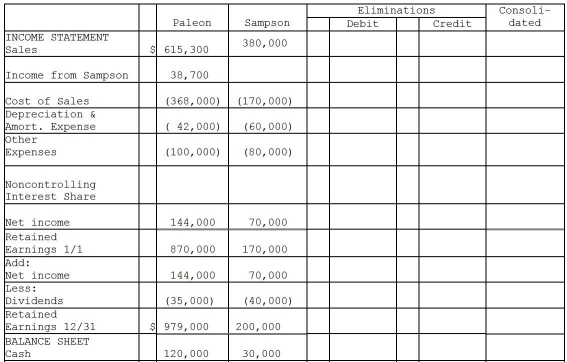

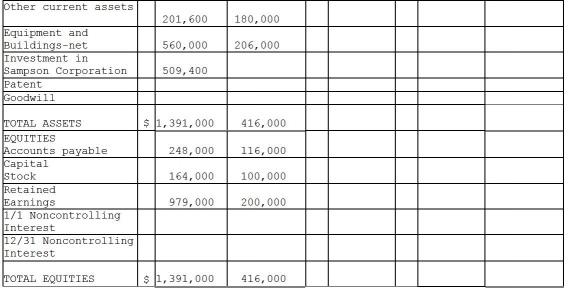

On January 2,2011,Paleon Packaging purchased 90% of the outstanding common stock of Sampson Shipping and Supplies for $513,000.Sampson's book values represented the fair values of all recorded assets and liabilities at that date,however Sampson had rights to a patent that was not recorded on their books,with an approximate fair value of $270,000,and a 10-year remaining useful life.Sampson's shareholders' equity reported on that date consisted of $100,000 in capital stock and $150,000 in retained earnings.Any remaining fair value/book value differential is assumed to be goodwill.The December 31,2012 financial statements for each of the companies are provided in the worksheet below.

Required: Complete the consolidation worksheet provided below to determine consolidated balances to be reported at December 31,2012.

Correct Answer:

Verified

_TB1535_00...

_TB1535_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: On consolidated working papers,a subsidiary's net income

Q9: On January 1,2011,Persona Company acquired 80% of

Q10: On December 31,2011,Paladium International purchased 70% of

Q11: Pennack Corporation purchased 75% of the outstanding

Q13: When performing a consolidation,if the balance sheet

Q16: In contrast with single entity organizations,consolidated financial

Q16: Flagship Company has the following information collected

Q17: Pecan Incorporated acquired 80% of the voting

Q27: A parent corporation owns 55% of the

Q38: When preparing the consolidation workpaper for a