Essay

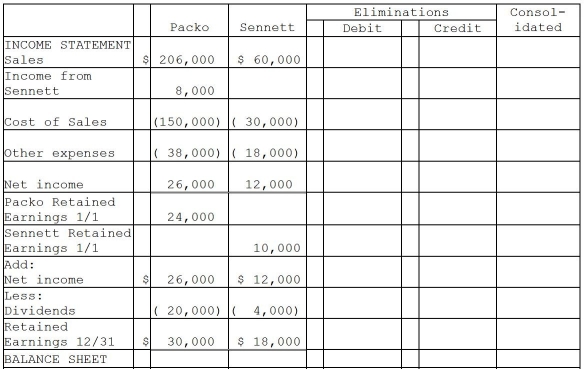

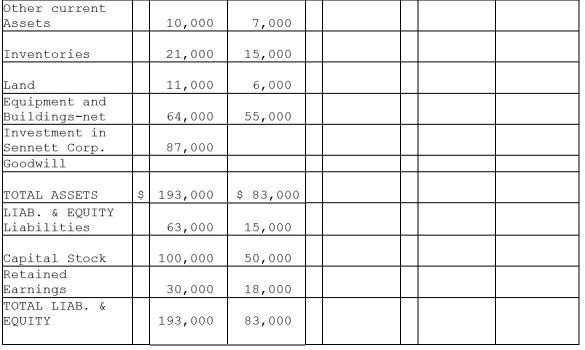

Packo Company acquired all the voting stock of Sennett Corporation on January 1,2010 for $90,000 when Sennett had Capital Stock of $50,000 and Retained Earnings of $8,000.The excess of fair value over book value was allocated as follows: (1)$5,000 to inventories(sold in 2010), (2)$16,000 to equipment with a 4-year remaining useful life(straight-line method of depreciation)and (3)the remainder to goodwill.

Financial statements for Packo and Sennett at the end of the fiscal year ended December 31,2011 (two years after acquisition),appear in the first two columns of the partially completed consolidation working papers.Packo has accounted for its investment in Sennett using the equity method of accounting.

Required:

Complete the consolidation working papers for Packo Company and Subsidiary for the year ending December 31,2011.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Powell Corporation acquired 90% of the voting

Q4: Bird Corporation has several subsidiaries that are

Q8: Which of the following will be debited

Q9: On January 1,2011,Persona Company acquired 80% of

Q10: On December 31,2011,Paladium International purchased 70% of

Q11: Pennack Corporation purchased 75% of the outstanding

Q25: Use the following information to answer question(s)

Q27: A parent corporation owns 55% of the

Q38: When preparing the consolidation workpaper for a

Q48: When preparing consolidated financial statements,which of the