Essay

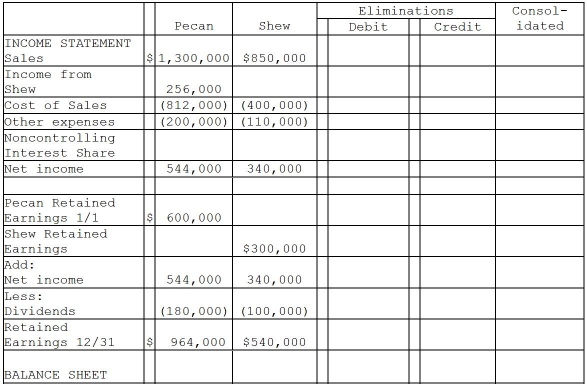

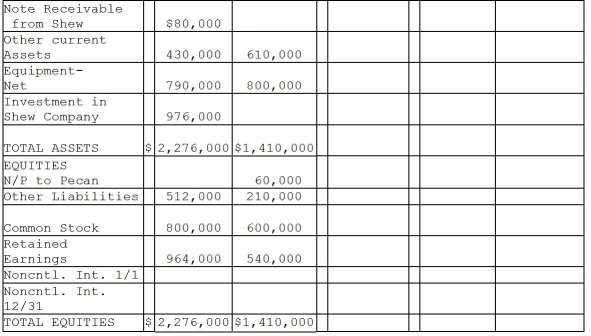

Pecan Incorporated acquired 80% of the voting stock of Shew Manufacturing for $800,000 on January 2,2011 when Shew had outstanding common stock of $600,000 and Retained Earnings of $300,000.The book value and fair value of Shew's assets and liabilities were equal except for equipment.The entire fair value/book value differential is allocated to equipment and is fully depreciated on a straight-line basis over a 5-year period.

During 2011,Shew borrowed $80,000 on a short-term non-interest-bearing note from Pecan,and on December 31,2011,Shew mailed a check for $20,000 to Pecan in partial payment of the note.Pecan deposited the check on January 4,2012,and recorded the entry to reduce the note balance at that time.

Required:

Complete the consolidation working papers for the year ended December 31,2011.

Correct Answer:

Verified

_TB1535_00...

_TB1535_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Use the following information to answer question(s)

Q6: On consolidated working papers,a subsidiary's net income

Q12: On January 2,2011,Paleon Packaging purchased 90% of

Q13: When performing a consolidation,if the balance sheet

Q16: Flagship Company has the following information collected

Q16: In contrast with single entity organizations,consolidated financial

Q18: Pigeon Corporation acquired an 80% interest in

Q19: On January 1,2011,Paisley Incorporated paid $300,000 for

Q21: On December 31,2010,Patenne Incorporated purchased 60% of

Q22: Parakeet Company has the following information collected