Essay

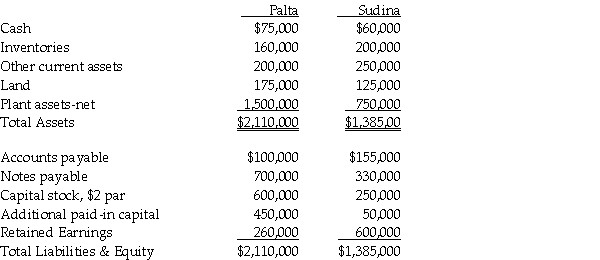

On January 2,2011 Palta Company issued 80,000 new shares of its $5 par value common stock valued at $12 a share for all of Sudina Corporation's outstanding common shares.Palta paid $5,000 for the direct combination costs of the accountants.Palta paid $18,000 to register and issue shares.The fair value and book value of Sudina's identifiable assets and liabilities were the same.Summarized balance sheet information for both companies just before the acquisition on January 2,2011 is as follows:

Required:

Required:

1.Prepare Palta's general journal entry for the acquisition of Sudina assuming that Sudina survives as a separate legal entity.

2.Prepare Palta's general journal entry for the acquisition of Sudina assuming that Sudina will dissolve as a separate legal entity.

Correct Answer:

Verified

1.General journal entry recorded by Palt...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: On January 2,2011,Pilates Inc.paid $900,000 for all

Q3: On January 2,2011,Pilates Inc.paid $700,000 for all

Q4: On January 2,2010 Carolina Clothing issued 100,000

Q5: Saveed Corporation purchased the net assets of

Q6: Balance sheet information for Sphinx Company at

Q8: According to FASB Statement 141R,which one of

Q10: Goodwill arising from a business combination is<br>A)charged

Q11: According to FASB Statement No.141,liabilities assumed in

Q12: Pony acquired Spur Corporation's assets and liabilities

Q34: Use the following information to answer