Essay

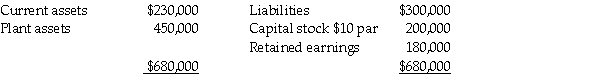

Balance sheet information for Sphinx Company at January 1,2011,is summarized as follows:

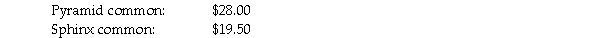

Sphinx's assets and liabilities are fairly valued except for plant assets that are undervalued by $50,000.On January 2,2011,Pyramid Corporation issues 20,000 shares of its $10 par value common stock for all of Sphinx's net assets and Sphinx is dissolved.Market quotations for the two stocks on this date are:

Sphinx's assets and liabilities are fairly valued except for plant assets that are undervalued by $50,000.On January 2,2011,Pyramid Corporation issues 20,000 shares of its $10 par value common stock for all of Sphinx's net assets and Sphinx is dissolved.Market quotations for the two stocks on this date are:

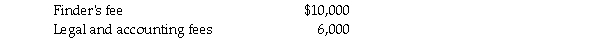

Pyramid pays the following fees and costs in connection with the combination:

Pyramid pays the following fees and costs in connection with the combination:

Required:

Required:

1.Calculate Pyramid's investment cost of Sphinx Corporation.

2.Calculate any goodwill from the business combination.

Correct Answer:

Verified

Requirement 1

_TB15...

_TB15...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: On January 2,2011,Pilates Inc.paid $900,000 for all

Q3: On January 2,2011,Pilates Inc.paid $700,000 for all

Q4: On January 2,2010 Carolina Clothing issued 100,000

Q5: Saveed Corporation purchased the net assets of

Q7: On January 2,2011 Palta Company issued 80,000

Q8: According to FASB Statement 141R,which one of

Q10: Goodwill arising from a business combination is<br>A)charged

Q11: According to FASB Statement No.141,liabilities assumed in

Q14: Under the provisions of FASB Statement No.141R,in

Q34: Use the following information to answer