Multiple Choice

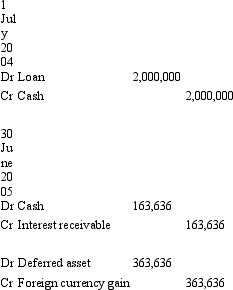

On 1 July 2004 Waugh Ltd enters into an arrangement with a US bank - Big Bank - to borrow US$900,000.The term of the loan is 3 years with interest payable annually in arrears on 30 June at the rate of 10 per cent.The exchange rate information is:  What journal entries are required in Waugh Ltd's books for 1 July 2004 and 30 June 2005 in accordance with AASB 121 (rounded to the nearest whole $A) ?

What journal entries are required in Waugh Ltd's books for 1 July 2004 and 30 June 2005 in accordance with AASB 121 (rounded to the nearest whole $A) ?

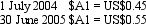

A)

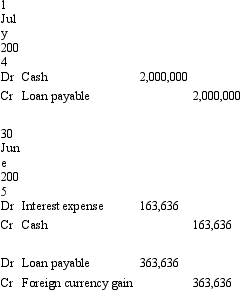

B)

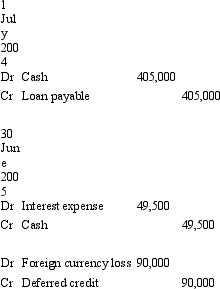

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Examples of monetary items that may be

Q18: The effect of a fall in the

Q19: Apart from some limited exceptions,AASB 121 requires

Q20: If the foreign currency exchange rate between

Q21: The Big Mac index is:<br>A) An indicator

Q23: What is the required treatment for long-term

Q24: Sure Ltd purchased goods for £210,000 from

Q25: AASB 123 Borrowing Costs defines a qualifying

Q26: Management may exercise its judgement to determine

Q59: To classify an arrangement as a hedge,and