Multiple Choice

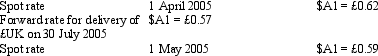

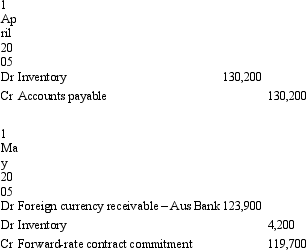

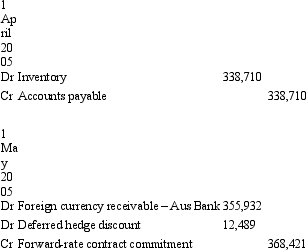

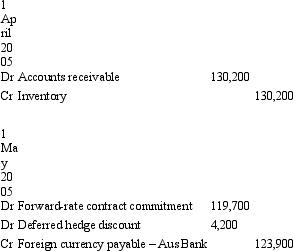

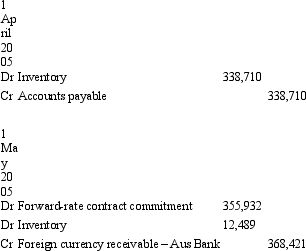

Sure Ltd purchased goods for £210,000 from a British supplier on 1 April 2005.The amount owing on the purchase is payable on 30 July 2005.On 1 May 2005 a forward-exchange contract for the delivery of £210,000 on 30 July 2005 is taken out with Aus Bank.Exchange rates are as follows:  What entries are required to record the initial transaction and the forward-exchange contract in accordance with AASB 121 and AASB 139 (rounded to the nearest whole $A) ?

What entries are required to record the initial transaction and the forward-exchange contract in accordance with AASB 121 and AASB 139 (rounded to the nearest whole $A) ?

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Apart from some limited exceptions,AASB 121 requires

Q20: If the foreign currency exchange rate between

Q21: The Big Mac index is:<br>A) An indicator

Q22: On 1 July 2004 Waugh Ltd enters

Q23: What is the required treatment for long-term

Q25: AASB 123 Borrowing Costs defines a qualifying

Q26: Management may exercise its judgement to determine

Q28: The following data is provided for the

Q29: Which of the following statements is correct

Q59: To classify an arrangement as a hedge,and