Multiple Choice

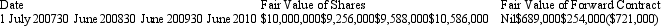

The following data is provided for the fair value of a share portfolio,and the fair value of a forward contract taken out on 1 July 2007 to 'hedge' movements in the fair value of the shares.Assume the hedge was highly effective at inception of the hedge.  Which of the following statements is true?

Which of the following statements is true?

A) It is not an effective hedge as there was a difference of $10,000,000 between the fair values of the shares and the forward contract at inception.

B) It is not an effective hedge as a forward contract cannot be used as a hedging instrument.

C) It is an effective hedge as the movement in the fair value of the hedging instrument between 1 July 2007 and 30 June 2010 offset movements in fair value of the shares in the same period, which is within the 80/125 per cent hedge effectiveness range.

D) It is an effective hedge as the movements in the fair value of the hedging instrument offset movements in fair value of the shares and stayed within the 80/125 per cent hedge effectiveness range throughout the period to 30 June 2010.

E) It is not an effective hedge as the movements in the fair value of the hedging instrument failed to offset movements in the fair value of the shares and stay within the 80/125 per cent hedge effectiveness range throughout the period to 30 June 2010.

Correct Answer:

Verified

Correct Answer:

Verified

Q23: What is the required treatment for long-term

Q24: Sure Ltd purchased goods for £210,000 from

Q25: AASB 123 Borrowing Costs defines a qualifying

Q26: Management may exercise its judgement to determine

Q29: Which of the following statements is correct

Q32: Exchange gains or losses on a qualifying

Q32: The effect of an increase in the

Q44: The functional currency of an entity is

Q59: To classify an arrangement as a hedge,and

Q69: According to AASB 123 a qualifying asset