Multiple Choice

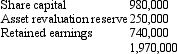

Window Ltd acquired a 70 per cent interest in Door Ltd on 1 July 2003 for a cash consideration of $1,399,000.At that date fair value of the net assets of Door Ltd were represented by:  On 1 July 2004 Window Ltd purchased a further 30 per cent of the issued capital of Door Ltd for cash consideration of $665,000.At this date the fair value of the net assets of Door Ltd were represented by:

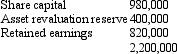

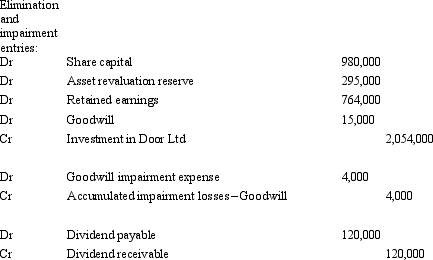

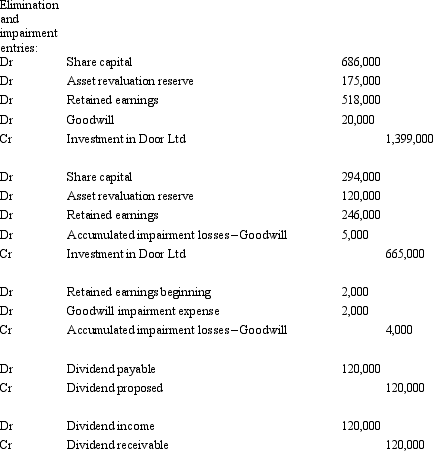

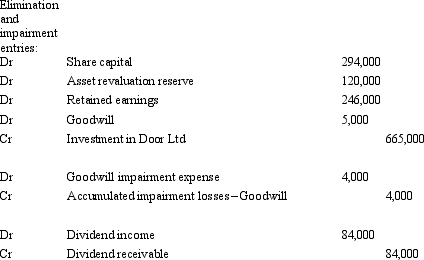

On 1 July 2004 Window Ltd purchased a further 30 per cent of the issued capital of Door Ltd for cash consideration of $665,000.At this date the fair value of the net assets of Door Ltd were represented by: Impairment of goodwill was assessed at $4,000; relating evenly across each of the last two years.During the period ended 30 June 2005,Door Ltd proposed a dividend of $120,000.The dividend has not been paid at the end of the period,but Window Ltd has a policy of accruing the dividends of subsidiaries when they are proposed.There were no other intragroup transactions.What are the consolidation entries to eliminate the investment in the subsidiary,account for goodwill and eliminate the dividends for the period ended 30 June 2005?

Impairment of goodwill was assessed at $4,000; relating evenly across each of the last two years.During the period ended 30 June 2005,Door Ltd proposed a dividend of $120,000.The dividend has not been paid at the end of the period,but Window Ltd has a policy of accruing the dividends of subsidiaries when they are proposed.There were no other intragroup transactions.What are the consolidation entries to eliminate the investment in the subsidiary,account for goodwill and eliminate the dividends for the period ended 30 June 2005?

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: The profit or loss on the sale

Q15: Fish Ltd acquired an 80 per cent

Q16: The following consolidation adjusting journal entries appeared

Q18: Under the step-by-step method,the need to revalue

Q19: Two common approaches to accounting for acquisition

Q22: Under the step-by-step method,the aggregate costs of

Q23: Mickey Ltd acquired a 70 per cent

Q24: An immediate parent entity may purchase shares

Q25: On 1 July 2002,City Ltd acquired 65

Q39: Once control over a subsidiary has been