Multiple Choice

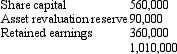

Fish Ltd acquired an 80 per cent interest in Chips Ltd on 1 July 2003 for a cash consideration of $838,000.At that date the fair value of the net assets of Chips Ltd was represented by:  On 30 June 2005 Fish Ltd sold all its shares in Chips Ltd for $950,000.At this date the fair value of the net assets of Chips Ltd was represented by:

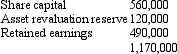

On 30 June 2005 Fish Ltd sold all its shares in Chips Ltd for $950,000.At this date the fair value of the net assets of Chips Ltd was represented by: The retained earnings of $490,000 includes operating profit after tax of $90,000 from the current period.Impairment of goodwill was assessed at $6,000.The investment has not been marked to market during the period that the shares were held.What is the amount of profit or loss on the sale of the shares recognised in the books of Fish Ltd during the period ended 30 June 2005?

The retained earnings of $490,000 includes operating profit after tax of $90,000 from the current period.Impairment of goodwill was assessed at $6,000.The investment has not been marked to market during the period that the shares were held.What is the amount of profit or loss on the sale of the shares recognised in the books of Fish Ltd during the period ended 30 June 2005?

A) $14,000

B) $112,000

C) $20,000

D) $118,000

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: The profit or loss on the sale

Q10: When additional shares in a subsidiary are

Q11: Spock Ltd acquired a 10 per cent

Q13: Which of the following statements is in

Q16: The following consolidation adjusting journal entries appeared

Q18: Under the step-by-step method,the need to revalue

Q19: Two common approaches to accounting for acquisition

Q20: In calculating the profit or loss on

Q20: Window Ltd acquired a 70 per cent

Q24: Control over a subsidiary may be lost