Multiple Choice

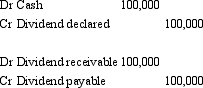

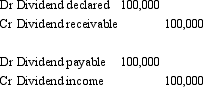

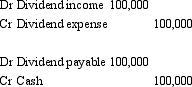

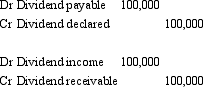

Monster Co Ltd owns 100 per cent of the issued shares of Mini Co Ltd.Mini Co Ltd declared a dividend of $100,000 for the period ended 30 June 2004.Monster Co Ltd accrues dividends when they are declared by its subsidiaries.What elimination entry would be required to prepare the consolidated financial statements for the group for the period ended 30 June 2005?

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Dividends may be identified as being paid

Q34: The level of equity ownership is not

Q36: Zeus Ltd owns 100 per cent of

Q37: Alice Ltd sold inventory items to its

Q38: Meat Ltd purchased 100 per cent of

Q39: Company A owns 51 per cent of

Q42: Aladdin Ltd sells inventory for a profit

Q43: Aladdin Ltd sold inventory items (with a

Q44: Zeus Ltd owns 100 per cent of

Q51: Intragroup profits are eliminated in consolidation to