Multiple Choice

On 1 July 2012,Felix Ltd acquires all shares in Oscar Ltd for $800 000.The fair value of net assets acquired is $620 000 comprised of $400,000 in share capital and $220 000 in retained earnings.What is the appropriate elimination entry for this investment that is in accordance with AASB 3 "Business Combinations" and AASB 127 "Consolidated and Separate Financial Statements"?

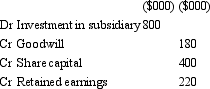

A)

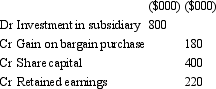

B)

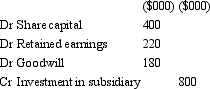

C)

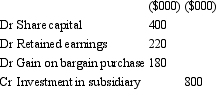

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q51: On 1 July 2012,Carol Ltd acquires all

Q52: Which of the following consolidation concepts are

Q53: Which of the following statements about post-acquisition

Q54: Arthur Ltd acquires all the issued capital

Q55: Which consolidation concept mainly underlies the approach

Q59: 'Passive' control implies that it is possible

Q59: Control is defined in AASB 3 as

Q60: Which of the following statements is not

Q61: Minority interests (minority interests)are defined as the

Q72: The first step in the consolidation process