Multiple Choice

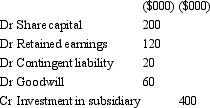

On 1 July 2012,Carol Ltd acquires all shares in Alice Ltd for $400 000.The fair value of net assets acquired is $320 000 comprised of $200,000 in share capital and $120 000 in retained earnings.On the date of purchase,a contingent liability is not recoded in the books of the acquiree but assumed by the acquirer.The contingent liability is estimated at $20 000 and likely to eventuate after acquisition.What is the appropriate elimination entry for this investment that is in accordance with AASB 3 "Business Combinations" and AASB 127 "Consolidated and Separate Financial Statements"?

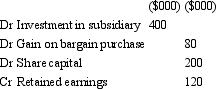

A)

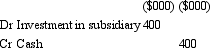

B)

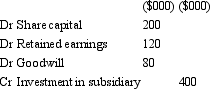

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q47: When group members do not apply the

Q48: On 1 July 2012,Bob Ltd acquires all

Q49: Gigi Ltd is acting as a trustee

Q52: Which of the following consolidation concepts are

Q53: Which of the following statements about post-acquisition

Q54: Arthur Ltd acquires all the issued capital

Q55: Which consolidation concept mainly underlies the approach

Q56: On 1 July 2012,Felix Ltd acquires all

Q66: 'Control' over a subsidiary,once determined as being

Q67: As prescribed in AASB 3 Business Combinations,when