Multiple Choice

Mendelssons Ltd has a machine that has been revaluing over a number of years.The valuation as at 1 January 2002 is $130,000.The previous valuation was $145,000 and the accumulated depreciation is $40,000.The revised salvage value is $15,000 and the estimated useful life remaining is 12 years.The benefits from the machine are expected to be derived evenly over its life.In the previous year,the machine had been devalued by $15,000 and this amount written off to the income statement.What are the entries at 1 January 2002 to record the revaluation and at 31 December 2002 to record depreciation?

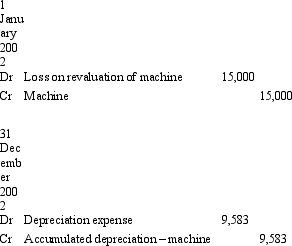

A)

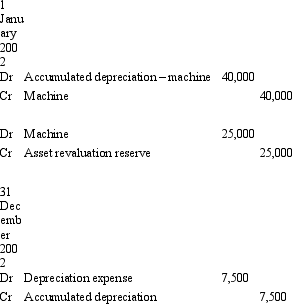

B)

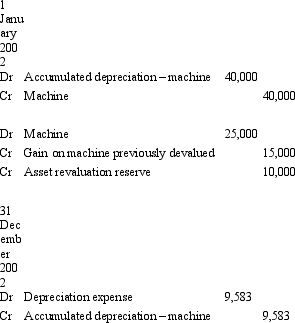

C)

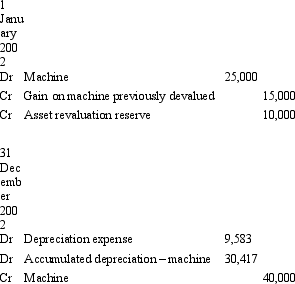

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: By permitting some classes of assets to

Q1: If an asset's carrying amount is impaired,AASB

Q2: AASB 116 requires entities to review at

Q3: Which of the following statement is true

Q6: Mozart Ltd acquired a building for $1.5

Q8: When an entity adopts the valuation model

Q9: Peters Ltd has a machine that originally

Q23: An entity that elects the revaluation model

Q26: The fair value of a non-current asset

Q71: AASB 136 does not require the use