Multiple Choice

Peters Ltd has a machine that originally cost $20,000 and has accumulated depreciation of $5,000.Its remaining life is assessed to be 5 years with no salvage value.The directors of Peters Ltd decide on 1 July 2003 to revalue the machine.They are unable to find market information on a machine in a similar state to theirs,so the market value of a new machine of the same type,$30,000,is used as a basis.What is/are the appropriate journal entry(ies) to record the revaluation?

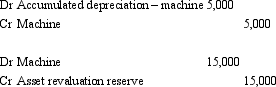

A)

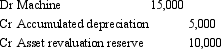

B)

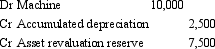

C)

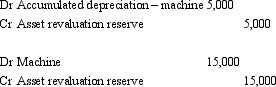

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: If an asset's carrying amount is impaired,AASB

Q5: Mendelssons Ltd has a machine that has

Q6: Mozart Ltd acquired a building for $1.5

Q8: When an entity adopts the valuation model

Q12: On disposal of an asset a gain

Q13: Staples Ltd has invested in two parcels

Q14: Research using the Positive Accounting Theory approach

Q23: An entity that elects the revaluation model

Q26: The fair value of a non-current asset

Q71: AASB 136 does not require the use