Multiple Choice

Staples Ltd has invested in two parcels of land that are treated as belonging to the same class of assets.The first parcel of land was purchased for $500,000 and has been valued this period at $650,000.The second parcel of land has a carrying value of $340,000 and has been valued this period at $100,000.What is the appropriate journal entry to record the revaluations?

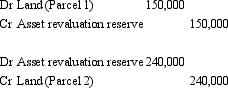

A)

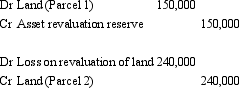

B)

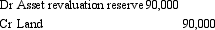

C)

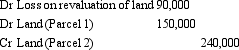

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: If an asset's carrying amount is impaired,AASB

Q8: When an entity adopts the valuation model

Q9: Peters Ltd has a machine that originally

Q12: On disposal of an asset a gain

Q14: Research using the Positive Accounting Theory approach

Q15: AASB 116 permits the following with respect

Q16: Under AASB 116 when an asset is

Q17: AASB 116 provides guidance on fair values

Q18: Brown,Izan and Loh (1992)found that revaluations are

Q71: AASB 136 does not require the use