Essay

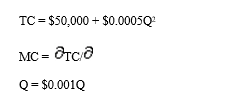

Compulsory Benefit Costs. The Telemarketing Louisianan Company generates leads for a major credit card company using over-the-phone solicitations. Each lead generated brings TLC $10 in fees, and these fees are stable given the competitive nature of the telemarketing business. TLC's relies upon independent contractors (sales associates) who work on a commission-only basis. Weekly total cost (TC) and marginal cost (MC) relations are:

where Q is thousands of refinancing applications processed.

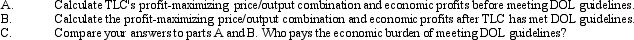

Suppose the US Department of Labor recently ruled that TLC's sales associates must be considered employees entitled to benefits under the Employee Retirement Income Security Act (ERISA). As a result, TLC's marginal cost of doing business will rise by $1 per unit. TLC's fixed expenses, which include a required return on investment, will be unaffected.

Correct Answer:

Verified

Correct Answer:

Verified

Q40: Competitive Strategy. Carry Underwood runs Tax Preparation

Q41: Recycling Fee and Elastic Demand. Assume that

Q42: Franchise Tax and Inelastic Demand. Assume the

Q43: In competitive market equilibrium, social welfare is

Q44: Producer surplus is the:<br>A) amount paid to

Q45: Profits stemming from market power reflect:<br>A) high

Q46: Franchise Tax and Inelastic Demand. Assume the

Q47: A price floor is a costly and

Q48: Undue market power is indicated when buyer

Q50: No externalities exist when:<br>A) private costs exceed