Multiple Choice

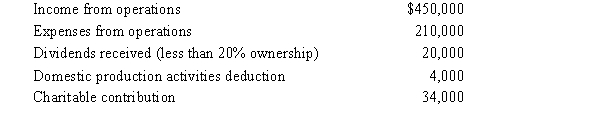

Rhino,Inc.,a calendar year C corporation,had the following income and expenses in 2008:

How much is Rhino's charitable contribution deduction for 2008?

A) $24,200.

B) $24,600.

C) $26,000.

D) $34,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q84: Albatross,a C corporation,had $200,000 net income from

Q85: The passive loss rules apply more favorably

Q86: An individual who owns a proprietorship must

Q87: Lou,an employee and sole shareholder of Amarillo

Q88: Red Corporation,which owns stock in Blue Corporation,had

Q90: Compare the basic tax and nontax factors

Q91: On December 29,2008,the directors of Greyhawk Enterprises

Q92: Macayo,Inc.,received $800,000 life insurance proceeds on the

Q93: Patrick,an attorney,is the sole shareholder of Gander

Q94: During 2008,Violet Corporation (a calendar year taxpayer)had