Essay

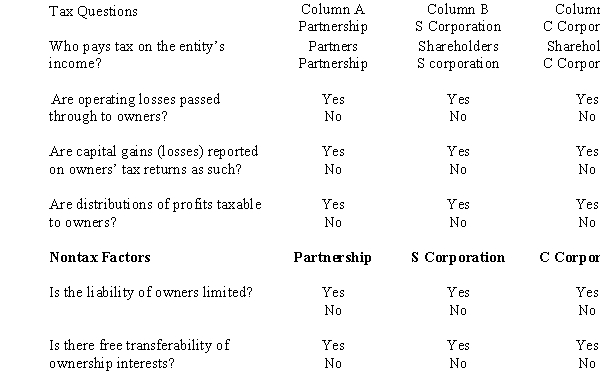

Compare the basic tax and nontax factors of doing business as a partnership,an S corporation,and a C corporation. Circle the corrent answers.

Correct Answer:

Verified

The correc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q85: The passive loss rules apply more favorably

Q86: An individual who owns a proprietorship must

Q87: Lou,an employee and sole shareholder of Amarillo

Q88: Red Corporation,which owns stock in Blue Corporation,had

Q89: Rhino,Inc.,a calendar year C corporation,had the following

Q91: On December 29,2008,the directors of Greyhawk Enterprises

Q92: Macayo,Inc.,received $800,000 life insurance proceeds on the

Q93: Patrick,an attorney,is the sole shareholder of Gander

Q94: During 2008,Violet Corporation (a calendar year taxpayer)had

Q95: In each of the following independent situations,determine