Essay

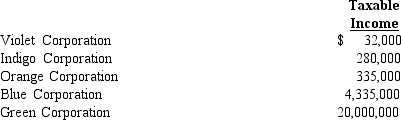

In each of the following independent situations,determine the corporation's income tax liability.Assume that all corporations use a calendar year and that the year involved is 2008.

Correct Answer:

Verified

Correct Answer:

Verified

Q90: Compare the basic tax and nontax factors

Q91: On December 29,2008,the directors of Greyhawk Enterprises

Q92: Macayo,Inc.,received $800,000 life insurance proceeds on the

Q93: Patrick,an attorney,is the sole shareholder of Gander

Q94: During 2008,Violet Corporation (a calendar year taxpayer)had

Q96: Peach Corporation had $135,000 of active income,$180,000

Q97: Chuck is the sole proprietor of Chuck's

Q98: A corporation with no taxable income need

Q99: Orange Corporation owns stock in White Corporation

Q100: Robin is a 50% shareholder in Robin-Wren,an