Multiple Choice

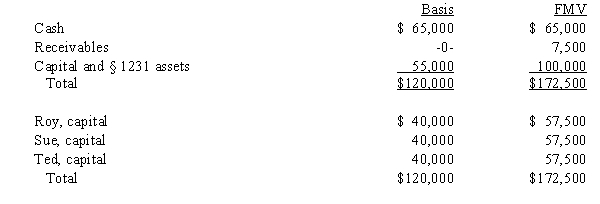

The December 31,2008,balance sheet of the RST General Partnership reads as follows.

The partners share equally in partnership capital,income,gain,loss,deduction and credit.Ted's adjusted basis for his partnership interest is $40,000.On December 31,2008,he retires from the partnership,receiving a $60,000 cash payment in liquidation of his interest.The partnership agreement states that $2,500 of the payment is for goodwill.Which of the following statements about this distribution is false?

A) If capital is NOT a material income-producing factor to the partnership, the § 736(a) payment will be $2,500.

B) If capital IS a material income-producing factor, the entire $60,000 payment will be a § 736(b) property payment.

C) The payment for Ted's share of goodwill will create $2,500 of ordinary income to him.

D) The partnership can deduct any amount which is a § 736(a) payment since it will be determined without regard to partnership profits.

E) All statements are false.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Matt,a partner in the MB Partnership,receives a

Q32: Match the following statements with the best

Q34: Terry received a proportionate share of partnership

Q35: The RBD Partnership balance sheet on August

Q40: Suzy owns a 25% capital and profits

Q41: Tim and Janet are equal partners in

Q42: The December 31,2008,balance sheet of the BCD

Q47: A § 754 election is made for

Q86: The Crimson Partnership is a service provider.

Q97: Match each of the following statements with