Essay

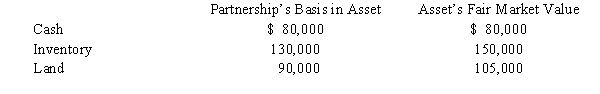

Suzy owns a 25% capital and profits interest in the calendar-year SJDV Partnership.Her adjusted basis for her partnership interest on July 1 of the current year is $200,000.On that date,she receives a proportionate nonliquidating current distribution of the following assets:

a.Calculate Suzy's recognized gain or loss on the distribution, if any.

b.Calculate Suzy's basis in the inventory received.

c.Calculate Suzy's basis in land received. The land is a capital asset.

d.Calculate Suzy's basis for her partnership interest after the distribution.

Correct Answer:

Verified

a.Suzy will not recognize any gain or lo...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Matt,a partner in the MB Partnership,receives a

Q32: Match the following statements with the best

Q35: The RBD Partnership balance sheet on August

Q37: The December 31,2008,balance sheet of the RST

Q41: Tim and Janet are equal partners in

Q42: The December 31,2008,balance sheet of the BCD

Q43: Match the following independent distribution payments in

Q44: Generally,gain is recognized on a proportionate current

Q96: Match the following statements with the best

Q97: Match each of the following statements with