Multiple Choice

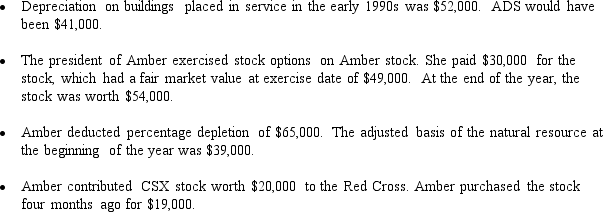

Amber,Inc.,has taxable income of $212,000.In addition,Amber accumulates the following information which may affect its AMT.

What is Amber's AMTI?

A) $212,000.

B) $233,000.

C) $238,000.

D) $249,000.

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q7: A limited partner in a limited partnership

Q25: Mr.and Ms.Smith's partnership owns the following assets:<br>*

Q26: Kirk is establishing a business in 2008

Q27: Kristine owns all of the stock of

Q28: Nevada is the only state that does

Q29: Ashley contributes property to the TCA Partnership

Q31: Discuss the tax consequences to the corporation

Q32: If a taxpayer contributes an appreciated asset

Q42: Match the following statements.<br>-Sale of corporate stock

Q96: Match the following statements.<br>-C corporations<br>A)Usually subject to