Multiple Choice

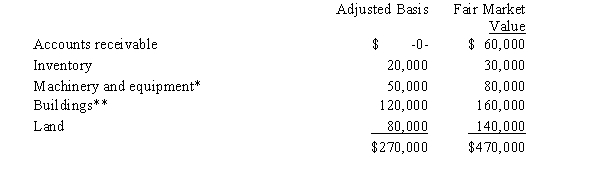

Kristine owns all of the stock of a C corporation which owns the following assets:

* Potential § 1245 recapture of $30,000.

** Straight-line depreciation was used.

Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $470,000.

A) $200,000 ordinary income.

B) $200,000 capital gain.

C) $100,000 ordinary income and $100,000 capital gain.

D) $90,000 ordinary income and $110,000 capital gain.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q22: The accumulated earnings tax rate in 2008

Q23: The special allocation opportunities that are available

Q24: Gus is the general partner and Laura

Q25: Mr.and Ms.Smith's partnership owns the following assets:<br>*

Q26: Kirk is establishing a business in 2008

Q28: Nevada is the only state that does

Q29: Ashley contributes property to the TCA Partnership

Q30: Amber,Inc.,has taxable income of $212,000.In addition,Amber accumulates

Q31: Discuss the tax consequences to the corporation

Q32: If a taxpayer contributes an appreciated asset