Multiple Choice

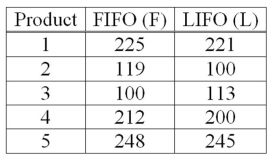

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  If you use the 5% level of significance, what is the critical t value?

If you use the 5% level of significance, what is the critical t value?

A) +2.132

B) ±2.132

C) +2.262

D) ±2.228

Correct Answer:

Verified

Correct Answer:

Verified

Q2: We test for a hypothesized difference between

Q32: When dependent samples are used to test

Q57: An investigation of the effectiveness of a

Q59: Accounting procedures allow a business to evaluate

Q60: When the population standard deviations are equal

Q61: If we are testing for the difference

Q62: When the standard deviations are equal but

Q63: Use the following table to determine whether

Q65: A financial planner wants to compare the

Q67: A national manufacturer of ball bearings is