Multiple Choice

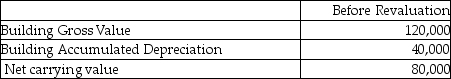

Grover Inc wishes to use the revaluation model for this property:  The fair value for the property is $100,000. What amount would be booked to the "accumulated depreciation" account if Grover chooses to use the elimination method to record the revaluation?

The fair value for the property is $100,000. What amount would be booked to the "accumulated depreciation" account if Grover chooses to use the elimination method to record the revaluation?

A) $20,000 credit

B) $40,000 debit

C) $40,000 credit

D) $80,000 debit

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Information about the PPE for Jeremy Inc.

Q20: What is the recoverable amount for this

Q23: Explain how an impairment loss is recorded

Q24: How is "discontinued operations" information presented in

Q25: What is a "component" of an entity?<br>A)A

Q46: What are "costs of disposal"?<br>A)The incremental costs

Q49: Which of the following is correct with

Q56: Which statement describes the "revaluation model"?<br>A)A model

Q64: Which statement is not correct?<br>A)Agricultural activity involves

Q83: Which of the following is correct with