Essay

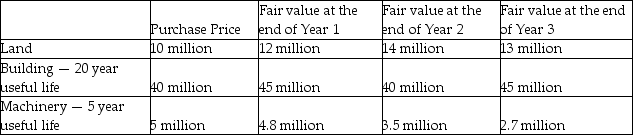

Information about the PPE for Jeremy Inc. is provided below. The company held the land and building to earn rental income and appropriately applied the fair value model for the land and building. Assume that the company takes a full of depreciation each year under the straight line method.

The company decided to use the building as its new head office at the beginning of year 3.

Prepare the journal entries required to record the change in use for Year 3.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Explain the meaning of biological assets and

Q20: What is the recoverable amount for this

Q22: Grover Inc wishes to use the revaluation

Q23: Explain how an impairment loss is recorded

Q24: How is "discontinued operations" information presented in

Q46: What are "costs of disposal"?<br>A)The incremental costs

Q56: Which statement describes the "revaluation model"?<br>A)A model

Q64: Which statement is not correct?<br>A)Agricultural activity involves

Q76: Which statement is correct?<br>A)Agricultural activity relates to

Q109: Which statement is correct?<br>A)The revaluation model is