Multiple Choice

Table 12.1

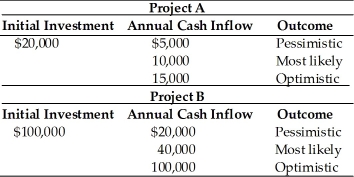

A corporation is assessing the risk of two capital budgeting proposals. The financial analysts have developed pessimistic, most likely, and optimistic estimates of the annual cash inflows which are given in the following table. The firm's cost of capital is 10 percent.

-The expected net present value of Project A if the outcomes are equally probable and the project has five-year life is ________. (See Table 12.1)

A) -$1,045

B) $17,910

C) $36,865

D) $93,730

Correct Answer:

Verified

Correct Answer:

Verified

Q19: The annualized net present value approach used

Q20: Table 12.5<br>Nico Manufacturing is considering investment in

Q21: The option to develop follow-on projects, expand

Q22: The danger that an unexpected change in

Q23: Foreign direct investment is the transfer of

Q25: In CAPM, the total risk is defined

Q26: Breakeven cash inflow refers to _.<br>A) the

Q27: Futures and options are opportunities that are

Q28: The acceptance of a particular project usually

Q29: Table 12.1<br>A corporation is assessing the risk