Essay

Table 12.5

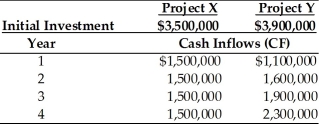

Nico Manufacturing is considering investment in one of two mutually exclusive projects X and Y which are described below. Nico Manufacturing's overall cost of capital is 15 percent, the market return is 15 percent and the risk-free rate is 5 percent. Nico estimates that the beta for project X is 1.20 and the beta for project Y is 1.40.

-Using the risk-adjusted discount rate method of project evaluation, find the NPV for projects X and Y. Which project should Nico select using this method? (See Table 12.5)

Correct Answer:

Verified

Project X should b...

Project X should b...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: The risk-adjusted discount rate (RADR) is the

Q16: The break even cash inflow is the

Q17: A preferred approach for risk adjustment of

Q18: In capital budgeting, risk refers to _.<br>A)

Q19: The annualized net present value approach used

Q21: The option to develop follow-on projects, expand

Q22: The danger that an unexpected change in

Q23: Foreign direct investment is the transfer of

Q24: Table 12.1<br>A corporation is assessing the risk

Q25: In CAPM, the total risk is defined