Multiple Choice

Table 12.2

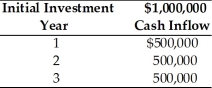

A firm is considering investment in a capital project which is described below. The firm's cost of capital is 18 percent and the risk-free rate is 6 percent. The project has a risk index of 1.5. The firm uses the following equation to determine the risk adjusted discount rate, RADR, for each project: RADR = Rf + Risk Index (Cost of capital - Rf)

-The net present value without adjusting the discount rate for risk is ________. (See Table 12.2)

A) $336,000

B) $250,000

C) $179,400

D) $87,000

Correct Answer:

Verified

Correct Answer:

Verified

Q81: A firm with unlimited funds must evaluate

Q82: A behavioral approach that evaluates the impact

Q83: Table 12.6<br>Yong Importers, an Asian import company,

Q84: Table 12.5<br>Nico Manufacturing is considering investment in

Q85: The output of simulation provides an excellent

Q87: The objective of _ is to select

Q88: Simulation is an approach that evaluates the

Q89: The _ approach is used to convert

Q90: A firm is evaluating two mutually exclusive

Q91: Table 12.4<br>Johnson Farm Implement is faced with