Multiple Choice

Table 12.6

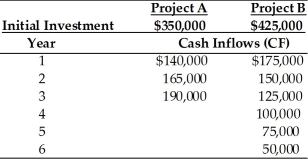

Yong Importers, an Asian import company, is evaluating two mutually exclusive projects, A and B. The relevant cash flows for each project are given in the table below. The cost of capital for use in evaluating each of these equally risky projects is 10 percent.

-The annualized NPV of Project B is ________. (See Table 12.6)

A) $11,673

B) $12,947

C) $38,227

D) $21,828

Correct Answer:

Verified

Correct Answer:

Verified

Q26: The risk-adjusted discount rate (RADR) is the

Q78: Different projects have different levels of risk.

Q80: Which of the following is an important

Q81: A firm with unlimited funds must evaluate

Q82: A behavioral approach that evaluates the impact

Q84: Table 12.5<br>Nico Manufacturing is considering investment in

Q85: The output of simulation provides an excellent

Q86: Table 12.2<br>A firm is considering investment in

Q87: The objective of _ is to select

Q88: Simulation is an approach that evaluates the