Multiple Choice

Table 12.3

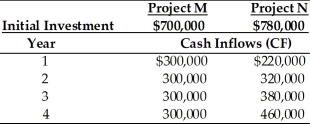

Tangshan Mining Company is considering investment in one of two mutually exclusive projects M and N which are described below. Tangshan Mining's overall cost of capital is 15 percent, the market return is 15 percent and the risk-free rate is 5 percent. Tangshan estimates that the beta for project M is 1.20 and the beta for project N is 1.40.

-Using the risk-adjusted discount rate method of project evaluation, the NPV for Project N is ________. (See Table 12.3)

A) $166,132

B) $122,970

C) $85,732

D) $600,000

Correct Answer:

Verified

Correct Answer:

Verified

Q96: Scenario analysis is a behavioral approach that

Q97: RADRs are popular because they are consistent

Q98: Scenario analysis is a statistics-based behavioral approach

Q99: When unequal-lived projects are independent, the length

Q100: Table 12.6<br>Yong Importers, an Asian import company,

Q101: Table 12.6<br>Yong Importers, an Asian import company,

Q102: All projects should always use the WACC

Q103: Exchange rate risk is easier to protect

Q104: A firm is evaluating two mutually exclusive

Q106: An IRR approach to capital rationing involves