Multiple Choice

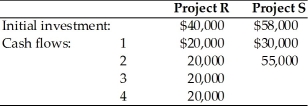

A firm is evaluating two mutually exclusive projects that have unequal lives. The firm must evaluate the projects using the annualized net present value approach and recommend which project they should select. The firm's cost of capital has been determined to be 14 percent, and the projects have the following initial investments and cash flows:

A) Choose Project R because its ANPV is $6459

B) Choose Project S because its ANPV is $6459

C) Choose Project R because its ANPV is $18,274

D) Choose Project S because its ANPV is $10,637

Correct Answer:

Verified

Correct Answer:

Verified

Q96: Scenario analysis is a behavioral approach that

Q97: RADRs are popular because they are consistent

Q98: Scenario analysis is a statistics-based behavioral approach

Q99: When unequal-lived projects are independent, the length

Q100: Table 12.6<br>Yong Importers, an Asian import company,

Q101: Table 12.6<br>Yong Importers, an Asian import company,

Q102: All projects should always use the WACC

Q103: Exchange rate risk is easier to protect

Q105: Table 12.3<br>Tangshan Mining Company is considering investment

Q106: An IRR approach to capital rationing involves