Multiple Choice

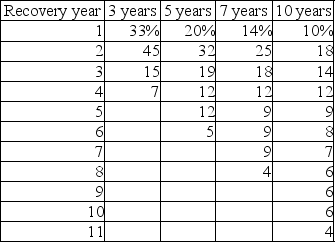

-A corporation is evaluating the relevant cash flows for a capital budgeting decision and must estimate the terminal cash flow. The proposed machine will be disposed of at the end of its usable life of five years at an estimated sale price of $2,000. The machine has an original purchase price of $80,000, installation cost of $20,000, and will be depreciated under the five-year MACRS. Net working capital is expected to decline by $5,000. The firm has a 40 percent tax rate on ordinary income and long-term capital gain. The terminal cash flow is ________.

A) $5,800

B) $7,800

C) $8,200

D) $6,200

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Benefits expected from proposed capital expenditures _.<br>A)

Q20: In case of an existing asset which

Q21: In computing after-tax operating cash flows, both

Q22: Table 11.4<br>Degnan Dance Company, Inc., a manufacturer

Q23: If an investment in a new asset

Q25: A corporation has decided to replace an

Q26: In evaluating a proposed project, incremental operating

Q27: Cash flows that could be realized from

Q28: Capital gain is the portion of the

Q29: Table 11.2<br>Computer Disk Duplicators, Inc. has been