Essay

Table 11.4

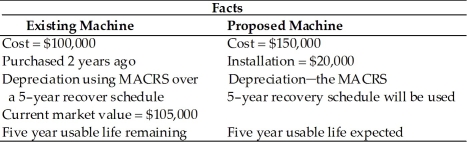

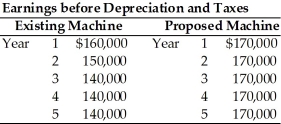

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.

-Given the information in Table 11.4 and 15 percent cost of capital,

(a) Compute the net present value.

(b) Should the project be accepted?

Correct Answer:

Verified

(a)  NPV = $77,812 -...

NPV = $77,812 -...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Recaptured depreciation is the portion of the

Q18: In developing the cash flows for an

Q19: Benefits expected from proposed capital expenditures _.<br>A)

Q20: In case of an existing asset which

Q21: In computing after-tax operating cash flows, both

Q23: If an investment in a new asset

Q24: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2929/.jpg" alt=" -A corporation is

Q25: A corporation has decided to replace an

Q26: In evaluating a proposed project, incremental operating

Q27: Cash flows that could be realized from